What Exactly Is A Capital Cost Allowance

Deciding on a Personal Loan: A Student's Guide

What Is an Expert Network?

A Review of the First Premier Mastercard

Dividend Per Share (DPS)

Sep 20, 2024 By Rick Novak

Are you looking for an effective way to increase your passive income? Growing dividends may be the answer! Dividend per share, or DPS, is an investment tool savvy investors use to turn stocks into steady income streams. Knowing what determines a company's dividend and how that affects you.

In this blog post, we'll cover all aspects of DPS, from what it is, how it works, and why strategies such as dividend reinvestment plans (DRIPs) are so popular with experienced investors. Stay tuned - You will want to take advantage of this valuable information!

What Is Dividend Per Share (DPS)?

Dividend Per Share (DPS) is the distribution of cash, stock, or other compensation that a company pays its shareholders. The amount of DPS typically depends on the company's net income and the board of directors' decision on how much should be distributed as dividends. The more profitable a company is, the higher the dividend per share it can offer to its shareholders.

How Does Dividend Per Share Work

A publicly-traded company will regularly declare a dividend payment, usually expressed in dollars per share. This payout will then be divided among all shareholders depending on how many shares each owns. For example, if you own 10 shares in a company and they distribute $5 in DPS, you will receive a dividend of $50.

Once a company declares the dividend per share they will pay out, shareholders must decide how to manage their dividends. One popular option is reinvestment, which allows investors to use their dividends to purchase additional shares of the same stock. This strategy boosts passive income over time as more and more shares are accumulated through reinvestment.

Why Are Dividend Reinvestment Plans (DRIPs) So Popular

Dividend Reinvestment Plans (DRIPs) allow for an automated way for shareholders to buy more stock without making any extra out-of-pocket payments. By investing the dividends automatically into the stock, investors can benefit from compounding returns over time. This also puts shareholders in a great position to take advantage of market dips and buy more stock at discounted prices.

Earnings Per Share (EPS) vs. Dividends Per Share (DPS)

Two metrics are used to evaluate a company's performance: EPS and DPS, or Dividends Per Share. While DPS depicts the amount of profit that will be distributed to shareholders as dividends, EPS shows how profitable a company is.

EPS shows the portion of a company’s profits allocated to each share of its stock. To calculate EPS, divide net income by the weighted average outstanding shares. This figure is important for investors because it helps them understand how profitable a company is and can inform their investment decisions accordingly.

On the other hand, DPS measures how much money shareholders receive in dividends per share owned. It is calculated by dividing with the total dividends paid in a given period by the number of outstanding shares. This figure is important for investors looking to passively generate income from their investments.

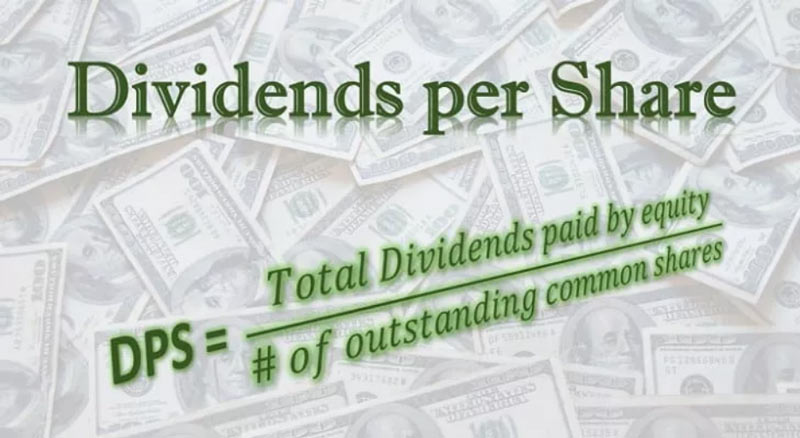

DPS Formula

The formula for calculating Dividend Per Share (DPS) is quite straightforward. It involves dividing the total dividends paid in a period by the outstanding shares. To calculate DPS, you divide your company’s total dividend payments over a set period by the number of fully diluted common shares outstanding during that period.

For example, if a company declared $50,000 in dividends to be distributed among its shareholders and there are 10 million shares outstanding, then the DPS would be calculated as follows: ($50,000 / 10,000,000) = $0.005 per share.

Dividend Per Share Examples

There are several different Dividend Per Share (DPS) examples that investors can use to assess the success and profitability of a company.

For example, if Company XYZ pays out $1 million in dividends during its fiscal year and has 10 million outstanding shares, then the DPS would be calculated as follows: ($1M/10M) = $0.10 per share.

Another common example is when a company pays out special dividends. These are usually one-time dividend payments that exceed the company's previous expectations or announcements. Let's say Company ABC declares a special payout of $50 million in addition to its regular dividend payment of $30 million. If this company has 25 million outstanding shares, the DPS would be calculated as follows: ($50M + $30M) / 25M = $1.20 per share.

Investors can learn more about a company's profitability and dividend-paying capacity from the dividend yield. To get this number, divide the total dividends paid in a year by the stock price at the time. For instance, a company's dividend yield would be 0.25 (or 25%) if its EPS were $0.10 and its current share price was $40.

Calculation of DPS

The calculation of Dividend Per Share (DPS) is a simple formula and involves dividing the total amount of dividends paid out in a given period by the number of outstanding shares. To calculate DPS, you divide your company’s total dividend payments over a set period by the number of fully diluted common shares outstanding during that period.

For example, if Company XYZ declared $50,000 in dividends to be distributed among its shareholders and there are 10 million shares outstanding, then the DPS would be calculated as follows: ($50,000 / 10,000,000) = $0.005 per share.

It's important to note that many companies offer different classes of stock with varying dividends. Depending on the type of stock, dividends can be paid out quarterly or annually.

Using DPS

A Dividend Per Share (DPS) can efficiently make money from your investments passively. Dividend per share (DPS) is computed by multiplying the number of outstanding shares by the total dividends paid for a specific period. Investors may see from this number how much they will get paid in dividends for each share they own.

Investors looking to make the most of their dividend payments can use strategies such as reinvestment plans (DRIPs). Through DRIPs, shareholders can reinvest their dividend payments into additional stock to benefit from compounding returns over time and take advantage of discounted prices.

FAQs

What are Dividend Reinvestment Plans (DRIPs)?

DRIPs are investment plans that allow investors to reinvest their dividends back into the stock, often at a discounted rate. This can be an effective strategy for growing your passive income over time as you accumulate more shares in the company and receive larger dividend payments. Additionally, many companies offer bonuses or discounts to those who enroll in DRIPs, making it an even more attractive option for savvy investors.

Are there any risks associated with investing in DPS?

Risk is always involved with any investment, and DPS is no exception. Companies may choose to reduce or eliminate their dividend payments at any time, which could impact your overall returns. Additionally, investors should be aware of the tax implications of their dividend payments, as they may be subject to taxes. Researching and understanding all aspects of DPS before investing is important to minimize potential risks.

What is the DPS dividend payout ratio?

The dividend payout ratio measures how much of a company's profits are paid out as dividends to its shareholders. This helps investors determine the amount of money they can expect to receive from their investments in a given year and the stability of those payments over time. A higher dividend payout ratio means that more of the company's profits are going directly back to shareholders, while a lower ratio could indicate that the company is holding on to more of its earnings and may not be able to provide consistent payments in the future.

Conclusion

Dividend per share is a great way for investors to increase their passive income. You can make informed decisions about your investments by understanding the basics of DPS, such as how it works, the risks involved, and the dividend payout ratio. Strategies such as DRIPs may also help you grow your capital over time. With the right research and knowledge, DPS could be a powerful tool for any investor looking to diversify their portfolio and maximize their return on investment.

Unlocking Savings: Finding the Best Mortgage Refinance Rates

How the TCJA Tax Law Affects Your Personal Finances

Best 0% APR Credit Cards

Available Balance: An Overview

How to Calculate Adjusted Gross Income (AGI) for Tax Purposes

Explain Different Types of Checking Accounts

How to Read a Consumer Credit Report