What Exactly Is Trading Before And After The Market Opens

A Review of the First Premier Mastercard

Best IRA Accounts

Unlocking Savings: Finding the Best Mortgage Refinance Rates

The Basics of an Actively Managed ETF

Sep 23, 2024 By Rick Novak

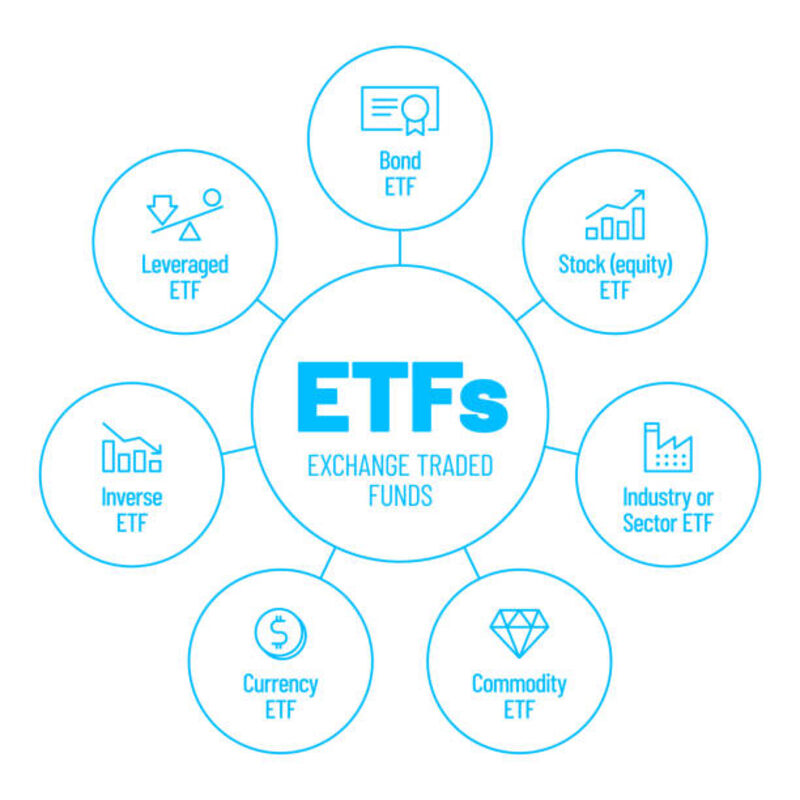

Actively managed ETFs (Exchange Traded Funds) are a relatively new type of investment. They are similar to traditional ETFs, but they are driven by skilled portfolio managers who make decisions regarding the allocation of assets and actively manage the fund’s investments to maximize returns. This differs from traditional ETFs, which generally track an index or benchmark passively.

What is an ETF?

An ETF is an investment fund that holds various securities, such as stocks, bonds, or commodities. It trades on a stock exchange and can be bought and sold like any other security. ETFs, offer investors exposure to various assets without purchasing individual stocks or bonds.

Actively managed ETFs are different from traditional passive ETFs in that the portfolio manager utilizes active management techniques to attempt to outperform the benchmark index or underlying asset class it tracks. This means that the portfolio manager decides when to buy and sell specific securities based upon their analysis of market conditions, economic trends, etc., rather than simply tracking an index as with passive funds.

Why are they important?

Actively managed ETFs are essential for investors wishing to have greater control over their investments. The portfolio manager can take advantage of market conditions or opportunities to maximize returns by actively managing the portfolio. Additionally, they may provide diversification benefits and lower costs than actively managed mutual funds, making them attractive options for many investors.

Types of ETFs:

Passively managed:

These ETFs track an index or benchmark, such as the S&P 500 or the Dow Jones Industrial Average.

Actively managed:

Actively managed funds are those where a portfolio manager decides when to buy and sell specific securities to outperform the underlying asset class it tracks.

Leveraged:

Leveraged ETFs use derivatives and other techniques to provide amplified exposure to an underlying security or market index. They can magnify returns but carry risks of more significant losses than traditional ETFs.

Inverse:

Inverse ETFs allow investors to gain exposure to an index or sector while profiting from price declines instead of increases.

Overall, actively managed ETFs can benefit investors with more control over their investments and provide greater returns than passively managed funds. It is essential to do your research before investing in any ETF and understand its associated risks.

It is essential to consult with a financial professional if you are considering investing in an actively managed fund. With the correct information and guidance, they can be a great way to diversify your portfolio.

Advantages of an actively managed ETF:

• Potential to outperform the market

• Lower costs than traditional actively managed funds

• Tax advantages over mutual funds

• Greater flexibility in asset allocation and diversification

Disadvantages of an actively managed ETF:

• Higher fees than passive ETFs

• Not all funds have a track record of success

• Risk of underperforming the benchmark index or underlying asset class.

How to choose the right actively managed ETF for you?

When choosing an actively managed ETF, consider the following factors:

• Fund performance: Analyze the fund’s track record and make sure it has a history of success.

• Fees: Ensure you understand all associated fees and expenses before investing in any ETF.

• Risk tolerance: Assess your risk appetite and how much risk you are comfortable taking on when investing.

• Investment goals: Consider your investment goals and make sure the fund is aligned with them.

• Portfolio diversification: As with any investment decision, diversification is critical. Make sure to spread your investments across different asset classes and sectors to reduce risk.

The bottom line

Actively managed ETFs are an excellent way for investors to have more control over their investments and potentially provide higher returns than passively managed funds. However, it is essential to research and understands the associated risks before investing in any ETF. Consult a financial professional if you need help choosing the right fund for your investment needs.

Risks associated with investing in an actively managed ETF:

• Market risk: As with any investment, actively managed ETFs are subject to market fluctuations and risks.

• Manager risk: Since the performance of an actively managed ETF is based on the skill of the portfolio manager, there is a risk that the fund may underperform its benchmark index or underlying asset class.

• Liquidity risk: If there is not enough trading activity in an ETF, it can be harder to exit a position in that fund. This could result in a lower price than expected or other unforeseen losses.

• Leverage risk: Leveraged ETFs carry additional risks related to using derivatives and other strategies that magnify returns but also increase potential losses.

Conclusion:

Actively managed ETFs can provide investors with greater control and potentially higher returns than passively managed funds, but they also come with risks. Before investing in any ETF, it is essential to do your research and understand the associated risks. You should also consult a financial professional if you need help choosing the right fund for your investment needs. With the correct information and guidance, actively managed ETFs can be a great way to diversify your portfolio.

FAQs:

Q: What are the advantages of an actively managed ETF?

A: The advantages of an actively managed ETF include the potential to outperform the market, lower costs than traditional actively managed funds, tax advantages over mutual funds, and greater flexibility in asset allocation and diversification.

Q: How do I choose the right actively managed ETF for me?

A: When choosing an actively managed ETF, consider factors such as fund performance, fees, risk tolerance, investment goals, and portfolio diversification. It is also essential to consult with a financial professional if you need help selecting the correct fund.

Q: What risks are associated with investing in an actively managed ETF?

A: Risks associated with investing in an actively managed ETF include market risk, manager risk, liquidity risk, and leverage risk. It is essential to understand these risks before investing.

Q: Are there any tax advantages of actively managed ETFs?

A: Yes, actively managed ETFs offer some tax advantages over traditional mutual funds due to the unique structure of ETFs. For example, many actively managed ETFs have lower turnover rates than mutual funds, which may result in fewer taxable events for investors.

ETF Dividend Payments: How it works?

Deciding on a Personal Loan: A Student's Guide

Available Balance: An Overview

How to Read a Consumer Credit Report

Timeshares: Unlocking the Vacation Dream or Falling into the Money Pit?

Dividend Per Share (DPS)

Which Is Better, a No-Penalty CD or a High-Yield Savings Account?