How to Read a Consumer Credit Report

Understanding Beneficiaries in Checking Accounts

ETF Dividend Payments: How it works?

What Exactly Is A Capital Cost Allowance

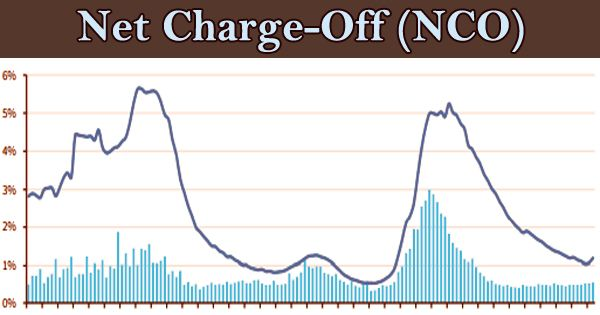

What Is a Net Charge-Off (NCO)?

Oct 12, 2024 By Kelly Walker

Net charge-off (NCO) is an accounting term that refers to a loan or credit card debt written off as uncollectible by the lender. When a borrower fails to make payments for several months, the lender will eventually determine that it is unlikely the debt will ever be paid and will remove the balance from its books.

This process is known as a net charge-off and is often done when the debt has gone unpaid for 180 days or more. The impact of an NCO on lenders can be significant, so it's important to understand what this term means and how it affects businesses and consumers.

Definition of a Net Charge-Off (NCO)

NCOs are debts that have been written off by lenders as uncollectible, meaning they will never be paid back. This occurs when a borrower has failed to make payments for several months, and the lender decides that the debt will unlikely be repaid. NCOs are generally reported after 180 days of non-payment.

Importance of understanding NCOs

The impact of an NCO on lenders can be far-reaching, so businesses and consumers alike need to understand what this term means. NCOs can harm the lender’s balance sheet, as well as its credit rating. They also result in the loss of income that would have been generated from the loan or credit card debt, so lenders are more likely to take a hard stance in recouping any losses.

For businesses, understanding NCOs is important for risk management and analysis. Having insight into how much of their money is being lost due to uncollectible debt can help them make better decisions regarding lending and credit policies. It can also help them identify areas where they may need to implement new strategies or tighten existing ones to prevent future losses.

For consumers, understanding NCOs is important for avoiding costly debt accumulation. Knowing that a lender will eventually remove unpaid balances from its books after a certain time can motivate borrowers to keep up with payments and stay within their credit limit. This can help them maintain a healthy credit score, which is essential for accessing future loans or credit cards.

Causes of NCOs

Lack of financial literacy

Many people don’t understand the basics of credit and debt management, leading to unsustainable borrowing and repayment habits. This lack of knowledge can contribute to NCOs when borrowers don’t make enough payments or exceed their credit limit.

Unforeseen circumstances

Sometimes life throws us unexpected financial curves, such as a job loss or medical emergency. These circumstances can result in borrowers falling behind on their payments, eventually leading to an NCO.

Fraudulent activity

In some cases, the cause of an NCO is the fraudulent activity or identity theft. This can occur when someone uses another person’s identity to take out a loan or credit card without their knowledge.

Definition of a charge-off

In financial terms, a charge-off is an accounting entry that reflects removing an unpaid debt from the balance sheet. It occurs when the lender determines it is unlikely they will ever recoup their losses and decides to write off the debt as uncollectible. The impact of a charge-off can be far-reaching for both lenders and consumers, so it is important to understand what this term means and how it affects your financial situation.

How NCOs Affect Banks and Lenders

The financial impact of NCOs

The impact of an NCO on a bank's balance sheet can be significant, as it will reduce the total amount of assets recorded. This is because the debt previously owed to the lender will no longer be considered part of their net worth. Furthermore, due to the increased risk associated with these loans and credit cards, lenders may also face higher interest rates when providing loans or credit cards to new borrowers.

NCOs also affect lenders in terms of lost income. Since the debt is no longer considered collectible, it can no longer generate revenue for the lender. This means they will need to offset this loss through other means, such as charging higher interest rates on future loans.

Effect on credit scores and credit reports

NCOs can harm the credit score of both lenders and consumers. For instance, when lenders report an NCO to the credit bureaus, it will generally decrease their credit score. Similarly, borrowers who have accumulated too much debt and failed to make payments for several months will see their credit rating drop significantly. This can make it more difficult for them to qualify for future loans and credit cards.

Additionally, NCOs will remain on the borrower’s credit report for seven years. In some cases, this may prevent them from obtaining a loan or a new line of credit during that time.

Why banks and lenders use NCOs to evaluate risk

NCOs are an important tool for banks and lenders when assessing the risk of potential borrowers. By reviewing past NCOs, lenders can determine whether a borrower has a history of struggling to pay off their debts. This information is then taken into account when deciding whether or not to extend credit to them. Additionally, lenders may use NCOs to identify fraudulent activity and protect their interests.

How NCOs Are Calculated

NCOs are calculated using the following formula: total loan receivables (x) minus total charge-offs (y) equals net charge-off rate. The resulting figure indicates the percentage of a lender’s loans written off as uncollectible. This number is then used to estimate expected losses due to bad debts and other factors.

The Difference Between Gross Charge-Offs and NCOs

It’s important to note that there is a difference between gross charge-offs and net charge-offs. Gross charge-offs refer to the total amount of debt written off as uncollectible, whereas net charge-offs consider any recovered funds from borrowers who have repaid their debts in part or in full. This means a lender’s net charge-off rate will be lower than their gross rate.

FAQs

How does an NCO affect a bank's balance sheet?

An NCO will reduce the number of assets recorded on the balance sheet, as the debt that was previously owed to the lender is no longer considered part of their net worth. Additionally, due to the increased risk associated with these loans and credit cards, lenders may face higher interest rates when providing loans or credit cards to new borrowers.

How does an NCO affect a consumer's credit score?

When lenders report an NCO to the credit bureaus, it will generally decrease their credit score. Similarly, borrowers who have accumulated too much debt and failed to make payments for several months will see their credit rating drop significantly. This can make it more difficult for them to qualify for future loans and credit cards. Additionally, NCOs will remain on the borrower’s credit report for seven years, which may prevent them from obtaining a loan or a new line of credit.

How to Prevent NCOs?

There are several steps that borrowers can take to prevent an NCO from occurring. First, it’s important to make payments on time and in full each month. Additionally, borrowers should keep their credit utilization ratio low by only taking out loans or credit cards they can manage and pay back responsibly.

Conclusion

Net charge-offs can have a significant impact on lenders and borrowers alike. By understanding what an NCO is, how it is calculated, and how to prevent it from happening, both parties can take steps to protect themselves from unexpected losses. With the right knowledge and precautions, lenders and borrowers alike can effectively manage their debt obligations and reduce their chances of incurring an NCO.

Dynamics of Supply and Demand in the Housing Market

Dividend Per Share (DPS)

Explain Different Types of Checking Accounts

How to Choose Between an ETC and an ETF.

What Exactly Is Trading Before And After The Market Opens

The Basics of an Actively Managed ETF

Business Credit Reports Vs. Consumer Credit Reports: An Overview